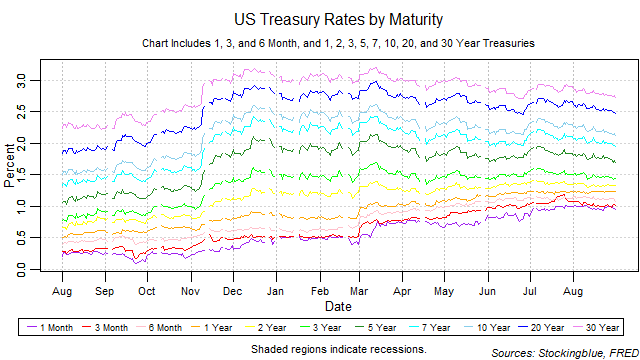

Short-term rates paused their steady rise in August but medium and long-term rates began to fall. The yield curve continues to shrink but it only indicates a recession if it shrinks from the bottom up. The upward tick in the short-term maturities' rates pause is promising as it is a decent indicator that a recession is not on the horizon. All rates fell in August with the exception of the one-year note which rose slightly.

Findings

- Only the one-year note rose in August, rising from 1.22 to 1.23.

- The 1-month rate surpassed the 3-month rate for one session in the month.

- Medium and long-term rates dropped faster than short-term rates.

- The drop in short-term rates is good news as this hints at no recession in the near future.

Caveats

- As always, past performance is not indicative of future results.

- The rates have been at historic lows for quite some time which has not occurred previously.

- Based on the dates of the rise in rates (slight rise in November with a more rapid increase from March onwards), this rise may be explained away by political factors and may not have anything to do with the underlying economy.

Details

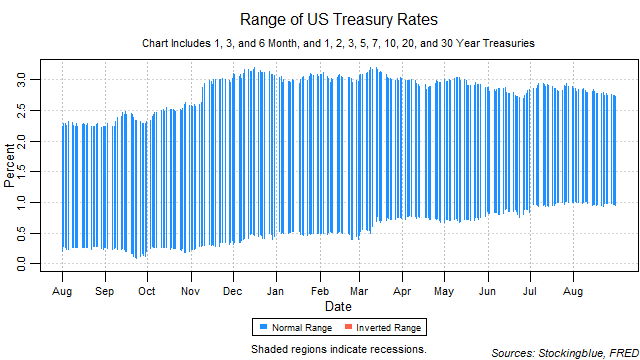

The breadth of the yield curve narrowed slightly over the month from a range of 1.86 to a range of 1.78. The widest range was 1.87 and the narrowest 1.76.

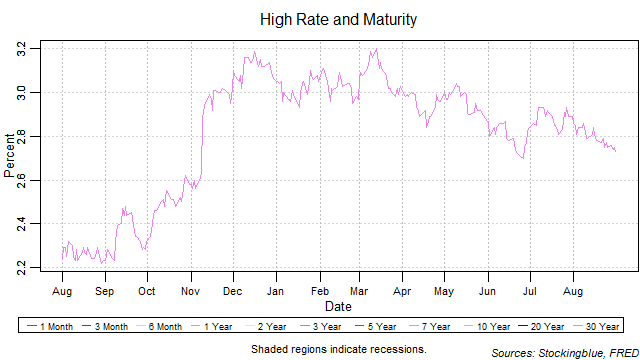

The thirty-year bond held the highest rate throughout the month but has been dropping steadily throughout the month.

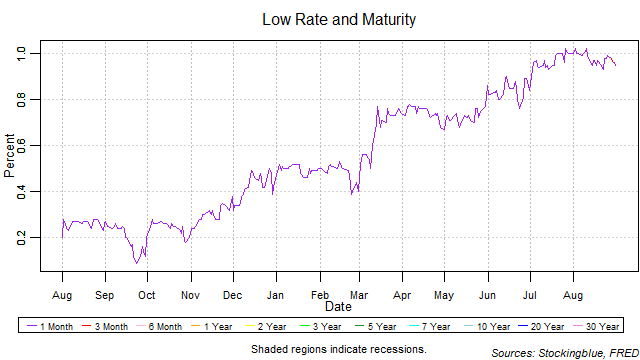

The one-month note held the lowest rate for every session except one when the three-month note held the lowest rate. In addition, it has stopped its steady rise and dropped below 1.0 percent.

Sources

"Treasury Constant Maturity," Federal Reserve Bank of St. Louis, accessed August 22, 2017, https://fred.stlouisfed.org/categories/115.