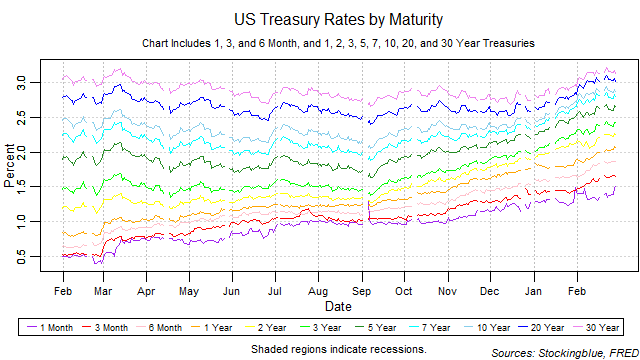

Short, medium, and long-term rates rose from the previous month. The yield curve widened a bit from the previous month and is on a two month widening streak. The one-month bill had maintained the lowest rate throughout the month.

Findings

- All rates from the one-month to the 30-year rose in February.

- The three-month and the 20-year rates saw the largest absolute growth at 0.19 points.

- The one-month rate saw the smallest growth at 0.07 points.

- On a relative basis, the three-month rate grew the most with a 13.01 percent rise.

- The one-month rate rose the least on relative terms with a 4.90 percent rise.

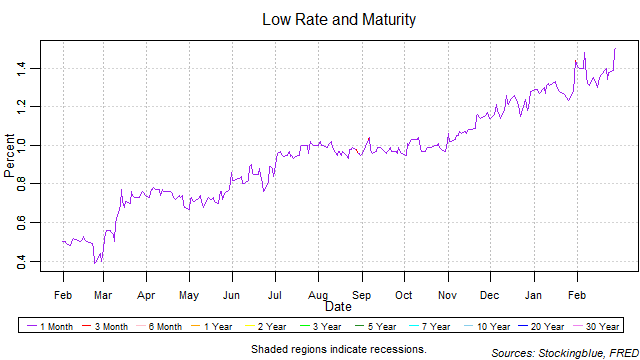

- The one-month bill maintained the lowest rate throughout the month.

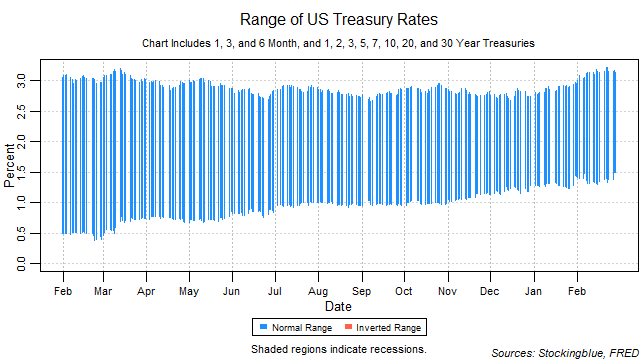

- The yield curve widened 0.11 points.

Caveats

- As always, past performance is not indicative of future results.

- The rates have been at historic lows for quite some time which has not occurred previously.

Details

The breadth of the yield curve widened over the month from a range of 1.52 to a range of 1.63. The widest range was 1.87 on February 22 and the narrowest 1.58 on February 8.

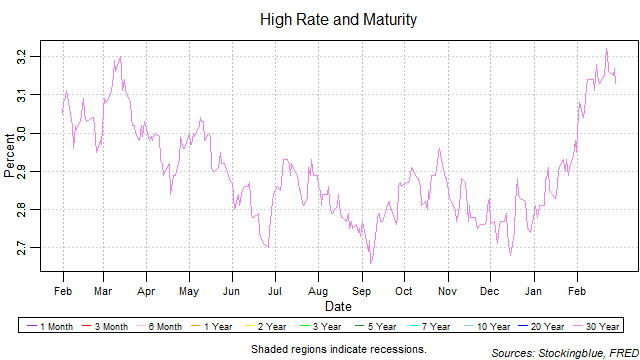

The thirty-year bond held the highest rate throughout the month. It has risen dramatically and burst past 3.0, 3.1, and 3.2 only to subside and end the month at 3.13.

The one-month note held the lowest rate for every session of the month. Although it has hit a new 12-month high twice in the month.

Sources

"Treasury Constant Maturity," Federal Reserve Bank of St. Louis, accessed February 1, 2018, https://fred.stlouisfed.org/categories/115.