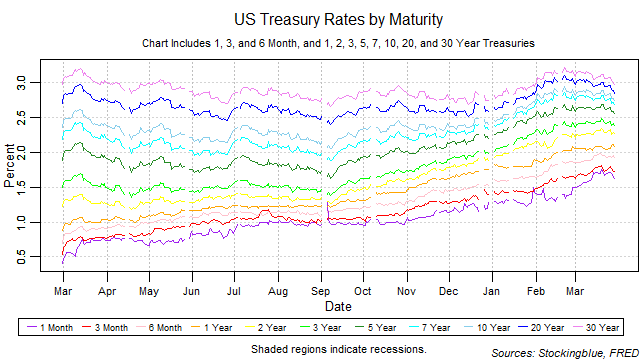

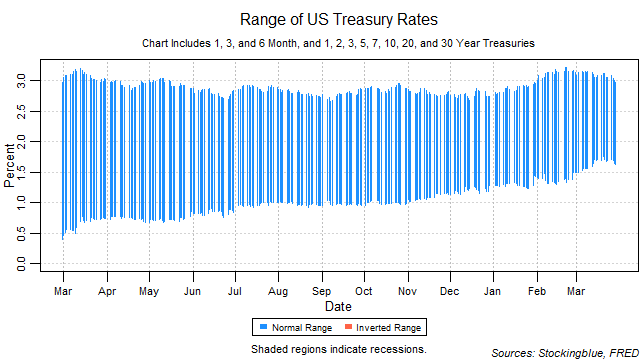

Short-term rates rose from the previous month, while long-term rates fell and medium-term rates were mixed. The yield curve narrowed from the previous month and broke its two month widening streak. Although the one-month bill rose the most, it maintained the lowest rate throughout the month. However, the yield curve has been narrowing from the short-term end for quite a while now and an inversion brought upon by rising short-term rates is a strong indicator for an upcoming recession. No inversion has occurred yet since this rise in short-term rates kicked off in late 2016.

Findings

- All rates from the one-month to the two-year rose in March.

- All rates from the three-year to the 30-year fell in March.

- The one-month rate saw the largest absolute growth at 0.13 points.

- The 20-year rate saw the largest drop at 0.17 points.

- On a relative basis, the one-month rate grew the most with a 8.67 percent rise.

- The 20-year rate fell the most on relative terms with a 5.63 percent drop.

- The one-month bill maintained the lowest rate throughout the month.

- The yield curve narrowed 0.29 points.

Caveats

- As always, past performance is not indicative of future results.

- The rates have been at historic lows for quite some time which has not occurred previously.

Details

The breadth of the yield curve narrowed over the month from a range of 1.63 to a range of 1.34. The widest range was 1.64 on March 2 and the narrowest 1.34 which was hit three times on March 14, 27, and 29.

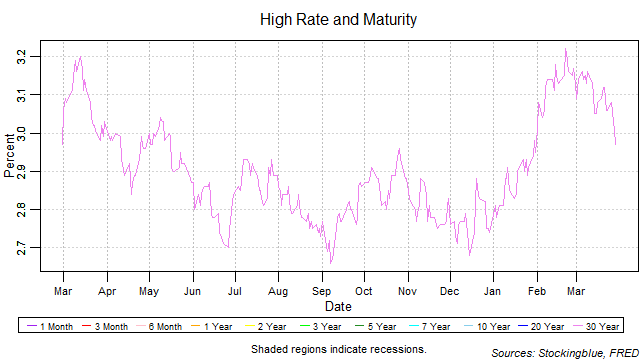

The thirty-year bond held the highest rate throughout the month. It has been dropping steadily however, throughout the month dropping below 3 percent on the final session of the month.

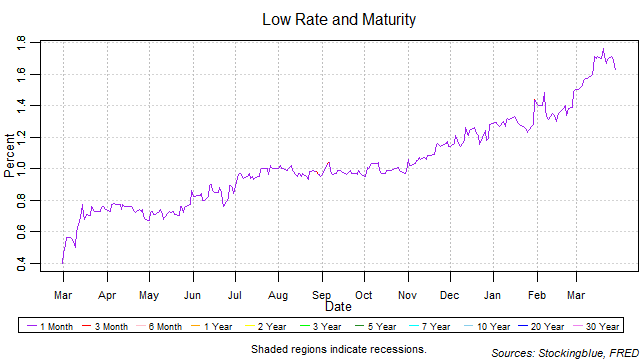

The one-month note held the lowest rate for every session of the month. For the fifth month in a row though, it has hit a new 12-month high only to drop after peaking at 1.76.

Sources

"Treasury Constant Maturity," Federal Reserve Bank of St. Louis, accessed April 2, 2018, https://fred.stlouisfed.org/categories/115.