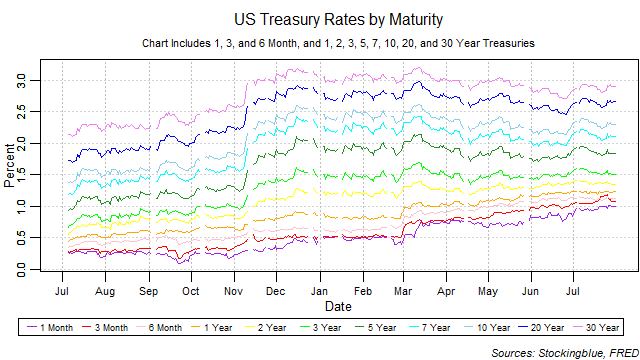

The month of July found short-term maturities' rates continuing their upward trend that started earlier in the year. Long-term maturities' rates have leveled off after dropping slightly earlier in the year. The upward tick in the short-term maturities' rates is troubling as it is a decent indicator of an ensuing recession. Only three out of eleven previous upticks in short-term rates have not led to an inversion of the yield curve.

Findings

- Short-term maturities' rates continue to climb in July.

- The 3-month rate surpassed the 6-month rate briefly (four sessions) in the month.

- Medium and long-term rates have leveled off.

- The rise in short-term rates is worrisome as it is a relatively reliable indicator of a recession.

Caveats

- As always, past performance is not indicative of future results.

- The rates have been at historic lows for quite some time which has not occurred previously.

- Based on the dates of the rise in rates (slight rise in November with a more rapid increase from March onwards), this rise may be explained away by political factors and may not have anything to do with the underlying economy.

Details

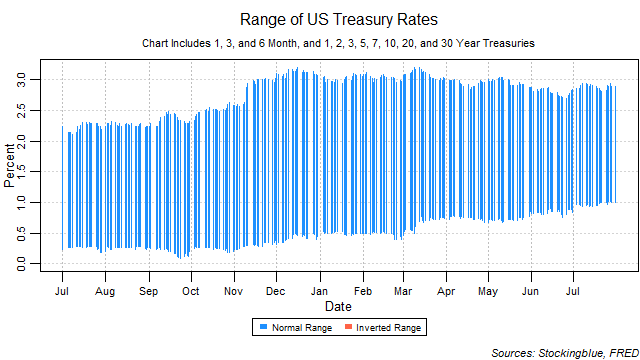

The breadth of the yield curve ended the month almost where it started narrowing by only a hundredth of a percentage point from a range of 1.90 to a range of 1.89. The widest range was 1.99 and the narrowest 1.81.

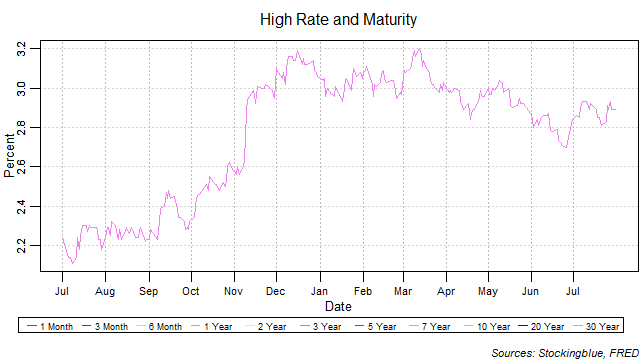

The thirty-year bond held the highest rate throughout the month. The bond fluctuated between 2.8 and 3.0 percent.

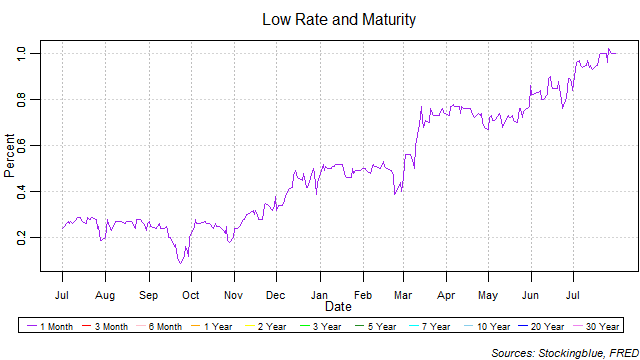

The one-month note held the lowest rate throughout the month. However, it is continuing its upward trend hitting the 1.0 percent mark for the first time in several years.

Sources

"Treasury Constant Maturity," Federal Reserve Bank of St. Louis, accessed August 22, 2017, https://fred.stlouisfed.org/categories/115.