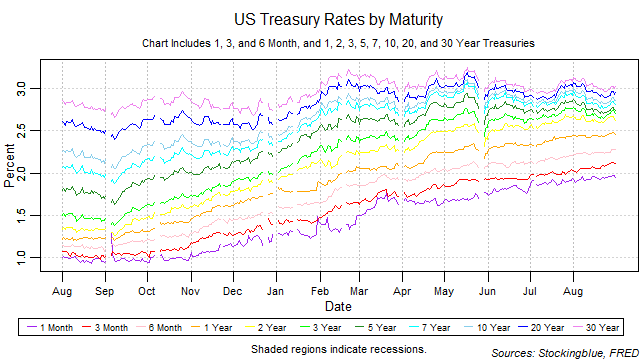

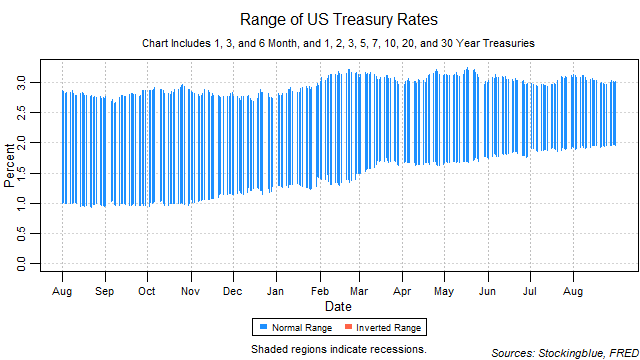

All short-term rates and the one-year rate rose in August while all other medium-term and long-term rates dropped. The yield curve narrowed from the previous month and extended its narrowing streak to four-months. The one-month bill maintained the lowest rate throughout the month. Short-term rates rose at a similar pace to the drop in long-term rates thus the yield curve narrowed equally from the bottom and the top keeping the risk of an inversion brought upon by rising short-term rates the same. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Findings

- All rates rose in August.

- The three-month rate saw the largest absolute growth at 0.08 points.

- On a relative basis, the three-month rate grew the most with a 3.94 percent rise.

- The five and seven-year rates saw the largest absolute drop at 0.11 points.

- On a relative basis, the five-year rate dropped the most with a 3.86 percent drop.

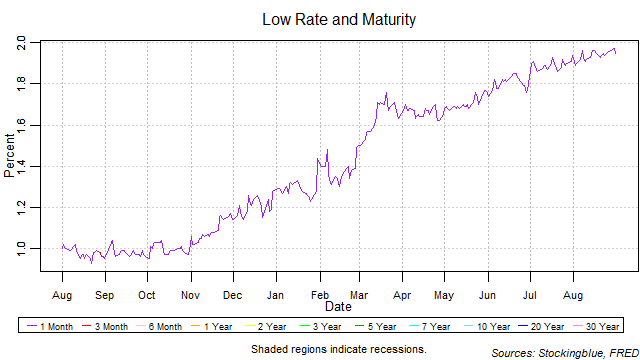

- The one-month bill maintained the lowest rate throughout the month.

- The yield curve narrowed 0.07 points.

Caveats

- As always, past performance is not indicative of future results.

- The rates have been at historic lows for quite some time which has not occurred previously.

Details

The breadth of the yield curve narrowed over the month from a range of 1.14 to a range of 1.07. The widest range was 1.23 (0.02 points higher than the previous month's widest range of 1.21) which was hit on August 2 and the narrowest 1.02 (0.02 points lower than the previous month's narrowest range of 1.04) which was hit on August 24.

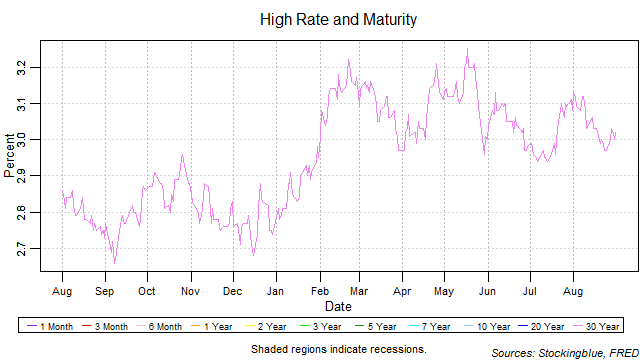

The thirty-year bond held the highest rate throughout the month. However, after a steady start, the rate dropped over the course of the month only to recover slightly in the final trading days. It has dropped below 3 percent on four sessions (August 20, 22, 23, and 24) but remained above it for the rest of the month. It should be noted that the 20-year rate was above 3 percent on the first seven trading days of the month.

The one-month note held the lowest rate for every session of the month. However, it has hit a new 12-month high for the fourth time in four months and has not been as high as 1.97 (its high for the month) since June 10, 2008 when it was at 2.00.

Sources

"Treasury Constant Maturity," Federal Reserve Bank of St. Louis, accessed September 5, 2018, https://fred.stlouisfed.org/categories/115.