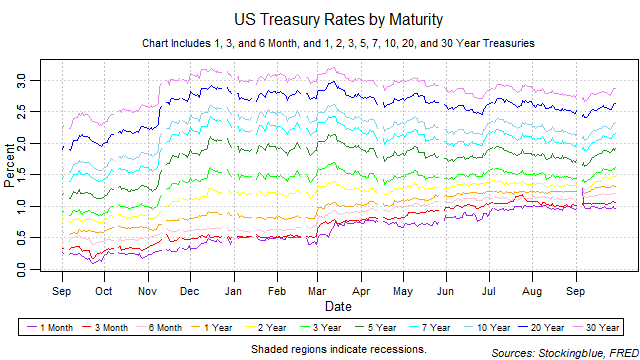

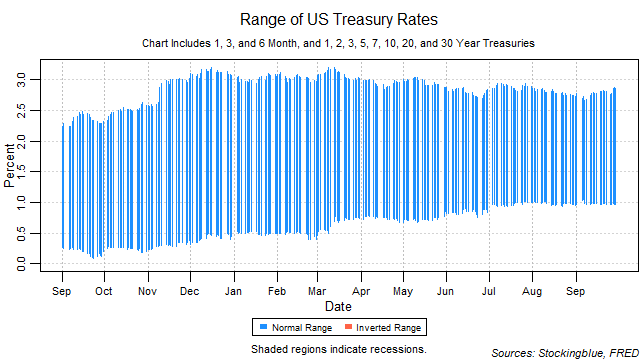

Short-term rates resumed their steady rise in September and medium and long-term rates returned to their relatively more rapid rise. The yield curve widened after narrowing further in the previous month. Short-term rates have slowed their rise in rates but September marks the second month in a row where the one-month bill had a session with higher rates than the three-month bill and an inversion of the yield curve from the bottom up has been a steadfast indicator of recession. No inversion has occurred yet but special attention needs to be paid to short-term rates in the near future. All rates rose in September.

Findings

- All maturities' rates rose in September with the five-year rate rising the most in both absolute and relative terms.

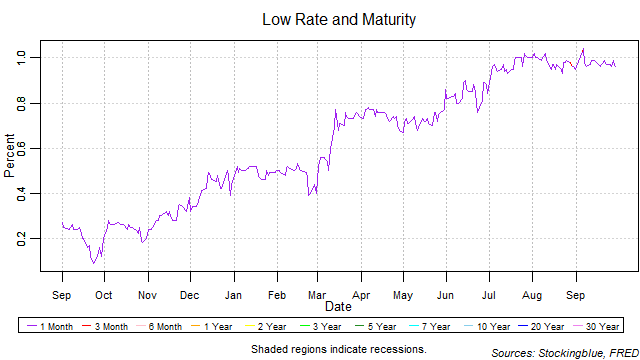

- The 1-month rate surpassed the 3-month rate for one session in the month for the second month in a row.

- Medium and long-term rates rose faster than short-term rates.

- The slow rise in short-term rates is good news as this hints at no recession in the near future.

Caveats

- As always, past performance is not indicative of future results.

- The rates have been at historic lows for quite some time which has not occurred previously.

Details

The breadth of the yield curve widened slightly over the month from a range of 1.78 to a range of 1.90. The widest range was 1.90 at the final two sessions of the month and the narrowest 1.66 on September 5.

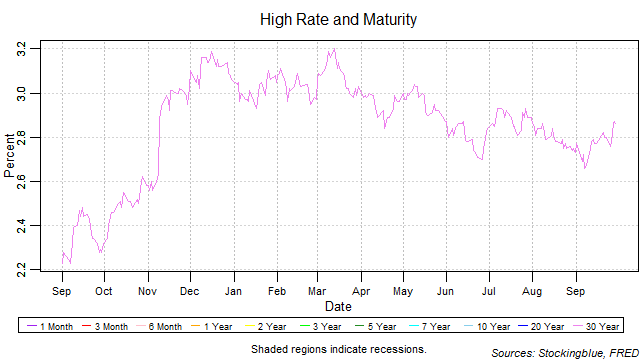

The thirty-year bond held the highest rate throughout the month and has had an upward trajectory with a couple of deep dives in between.

The one-month note held the lowest rate for every session except one when the three-month note held the lowest rate. In addition, it continues to flirt with one percent.

Sources

"Treasury Constant Maturity," Federal Reserve Bank of St. Louis, accessed September 30, 2017, https://fred.stlouisfed.org/categories/115.