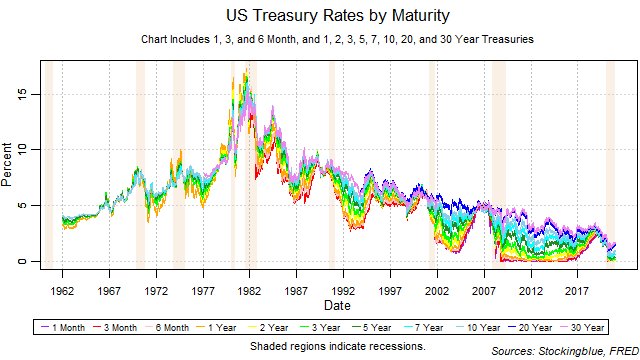

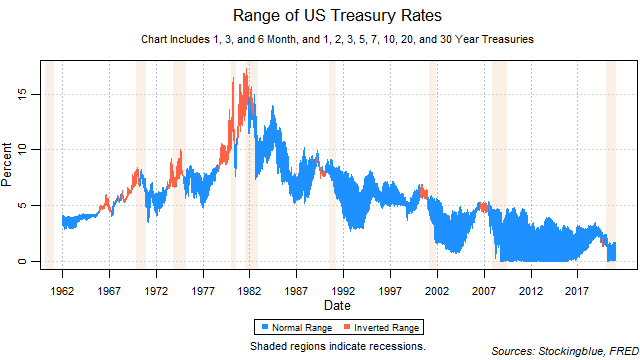

All rates trended downwards for the second year in a row. The yield curve widened over the course of the year. A narrowing from the short-term is a warning sign for an inversion that indicates recession.

Findings

- All rates dropped in 2020.

- The 30-year rate saw the smallest absolute drop at 0.68 points.

- The six-month rate saw the largest drop at 1.48 points.

- On a relative basis, the 30-year rate dropped the least with a 29.18 percent drop.

- The one-month rate dropped the most on relative terms with a 94.77 percent drop.

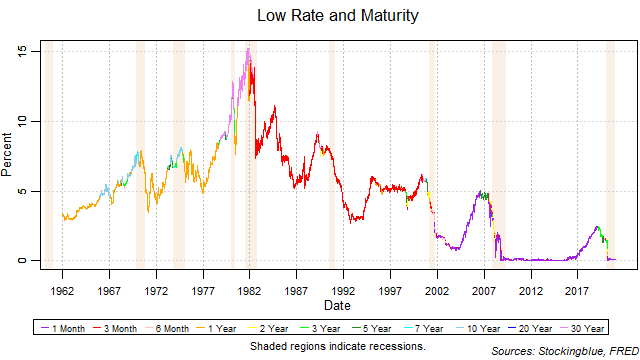

- The one-month bill did not maintain the lowest rate throughout the year.

- The yield curve widened 0.85 points.

Caveats

- As always, past performance is not indicative of future results.

- The rates have been at historic lows for quite some time which has not occurred previously.

Details

The breadth of the yield curve widened over the year from a range of 0.80 to a range of 1.65. The widest range was 1.75 on March 18 and the narrowest range was 0.60 which occurred on February 19, February 20, and February 21.

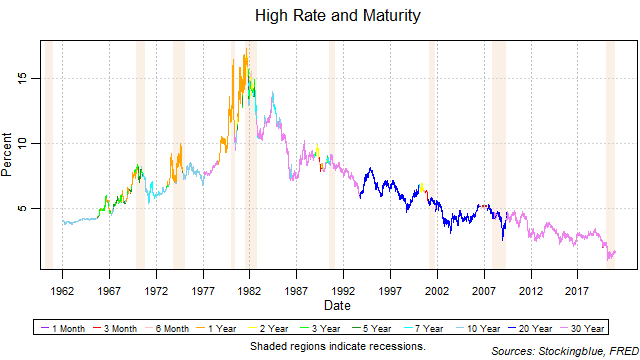

The thirty-year bond held the highest rate throughout the year.

The one-month bill had trouble holding the lowest rate for a good chunk of the year.

Sources

"Treasury Constant Maturity," Federal Reserve Bank of St. Louis, accessed January 7, 2021, https://fred.stlouisfed.org/categories/115.

"US Business Cycles and Contractions," National Bureau of Economic Research, accessed January 7, 2021, https://www.nber.org/research/data/us-business-cycle-expansions-and-contractions.