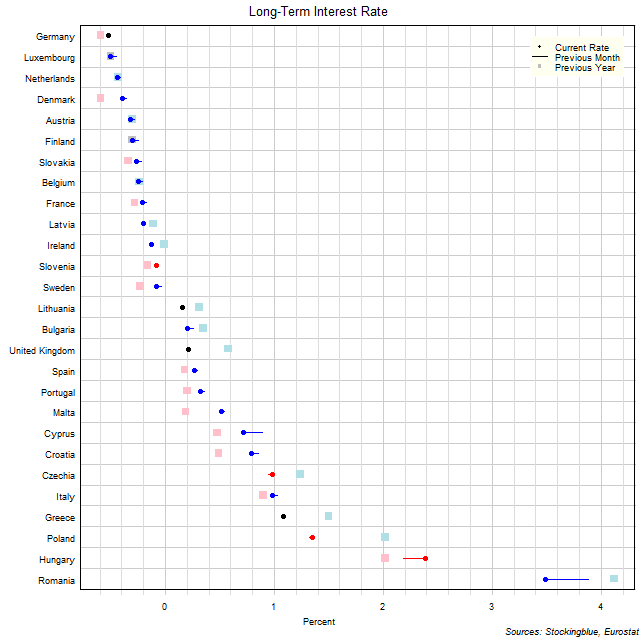

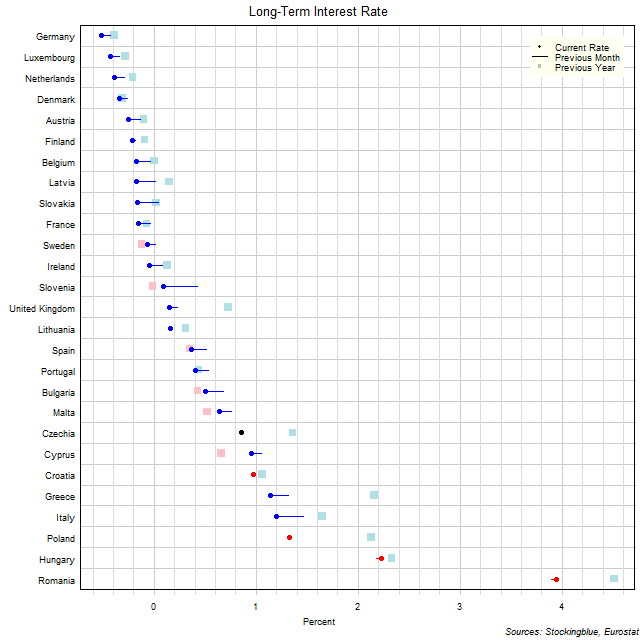

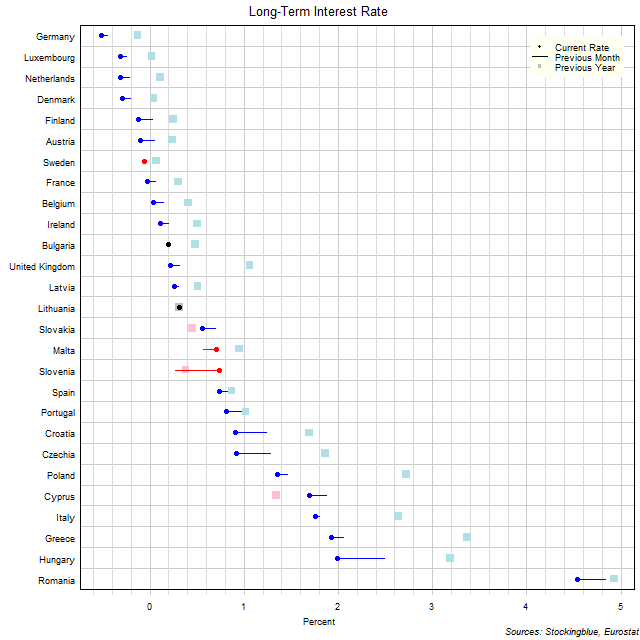

EU Long-Term Interest Rates, September 2020

The chart above shows the ten-year interest rate in each EU state as of September 2020, the change from the previous month, and the rate one year prior. Thirteen states have a negative interest rate (same as 13 last month and same as 13 last year).

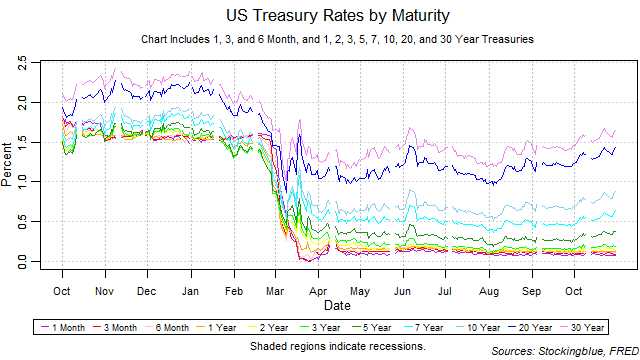

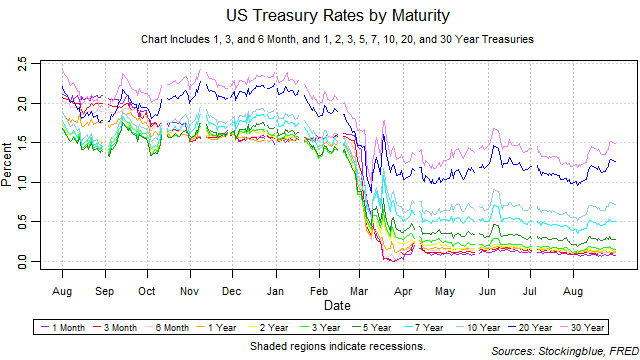

Treasury Rate Movements, October 2020

The three-month rate fell, the one-month and six-month rates stayed the same, and all other rates rose in October. The yield curve widened from the previous month thus ending its narrowing streak of one month. The one-month bill did not maintain the lowest rate throughout the month and shared it with the three-month on several occasions. There were no moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

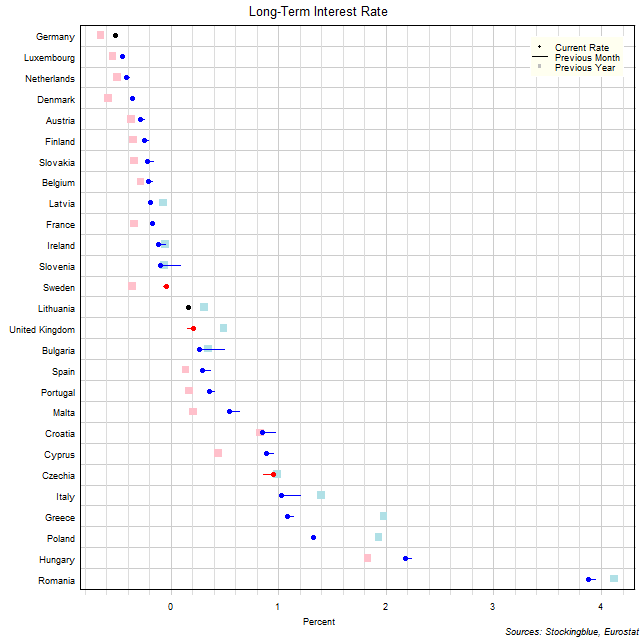

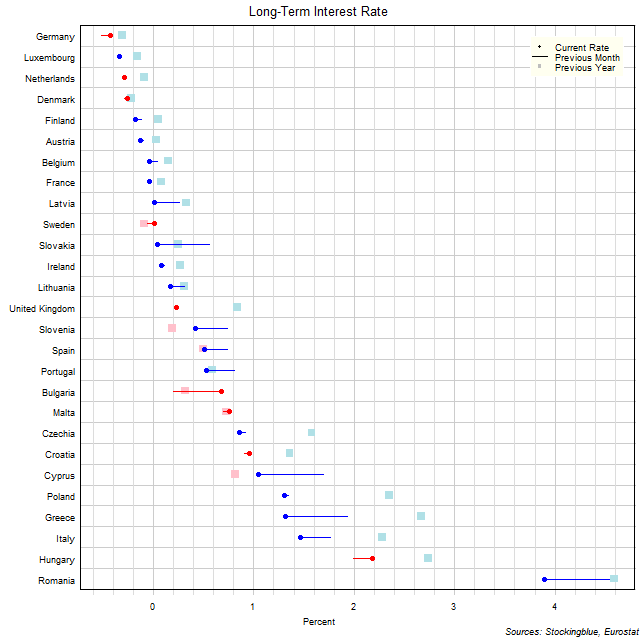

EU Long-Term Interest Rates, August 2020

The chart above shows the ten-year interest rate in each EU state as of August 2020, the change from the previous month, and the rate one year prior. Thirteen states have a negative interest rate (up from 12 last month and same as 13 last year).

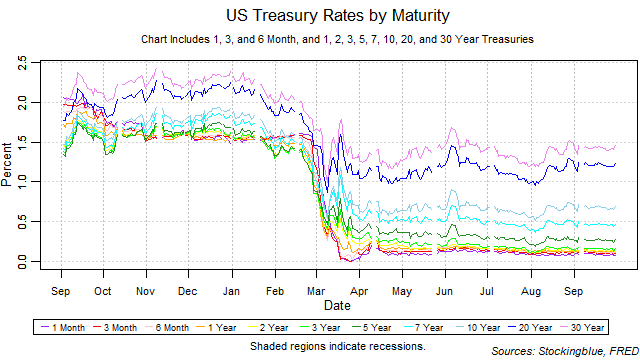

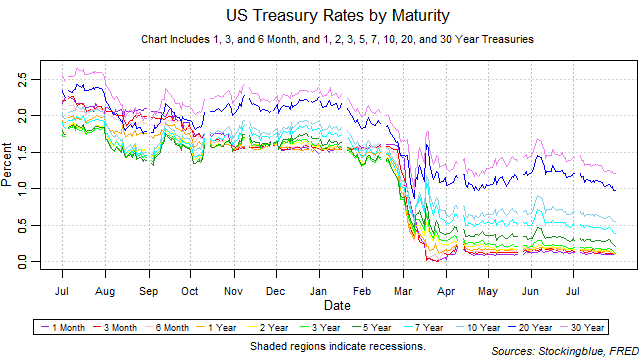

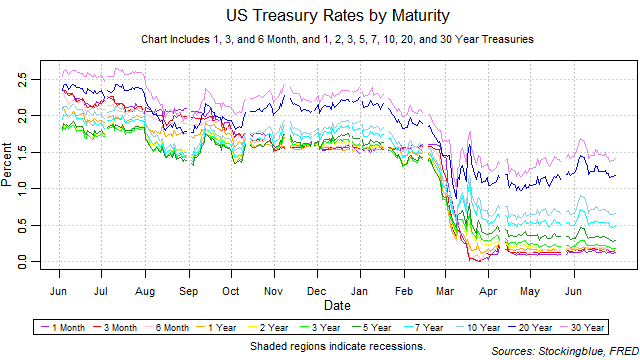

Treasury Rate Movements, September 2020

The three-year rate rose, the one-month, one-year, and five-year rates stayed the same, and all other rates dropped in September. The yield curve narrowed from the previous month thus ending its widening streak of one month. The one-month bill maintained the lowest rate throughout the month but shared it with the three-month on one occasion. There were no moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

EU Long-Term Interest Rates, July 2020

The chart above shows the ten-year interest rate in each EU state as of July 2020, the change from the previous month, and the rate one year prior. Twelve states have a negative interest rate (up from eight last month and up from nine last year).

Treasury Rate Movements, August 2020

All rates except for the one-month bill rose in August. The yield curve widened from the previous month thus ending its narrowing streak of one month. The one-month bill did not maintain the lowest rate throughout the month. There were no drastic moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

EU Long-Term Interest Rates, June 2020

The chart above shows the ten-year interest rate in each EU state as of June 2020, the change from the previous month, and the rate one year prior. Eight states have a negative interest rate (same as eight last month and up from five last year).

Treasury Rate Movements, July 2020

All rates fell in July. The yield curve narrowed from the previous month thus ending its steady streak of one month. The one-month bill did not maintain the lowest rate throughout the month. There were no drastic moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

EU Long-Term Interest Rates, May 2020

The chart above shows the ten-year interest rate in each EU state as of May 2020, the change from the previous month, and the rate one year prior. Eight states have a negative interest rate (up from five last month and up from one last year).

Treasury Rate Movements, June 2020

The one, three, five, and seven-year rates fell while the one and six-month and the two, 20, and 30-year rates remained the same, and the three-month and ten-year rates rose in June. The yield curve remained unchanged from the previous month thus ending its widening streak of one month. The one-month bill maintained the lowest rate throughout the month. There were no drastic moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

OlderNewer