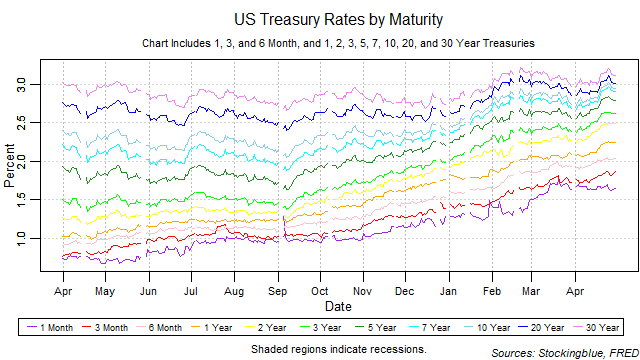

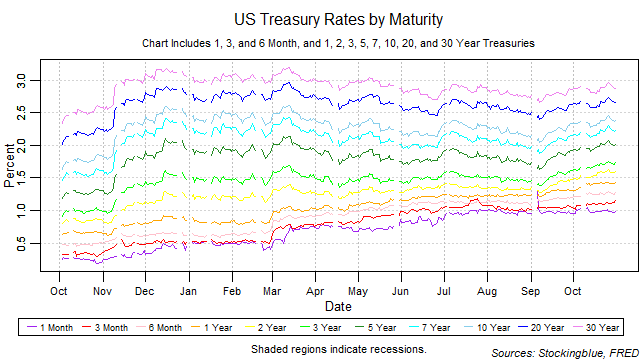

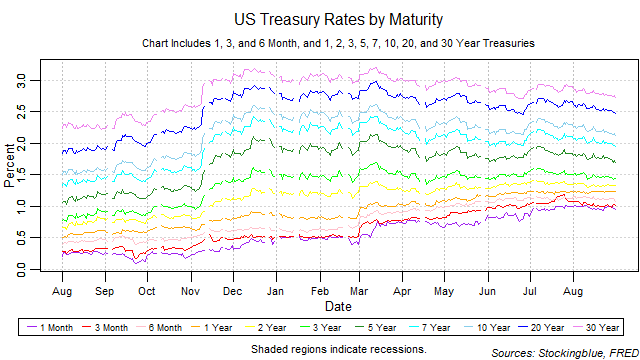

Treasury Rate Movements, April 2018

Short, medium, and long-term rates all rose from the previous month. The yield curve widened from the previous month and broke its one-month narrowing streak. The one-month bill maintained the lowest rate throughout the month. As the one-month rate had the smallest increase in both absolute and relative terms, the yield curve widened reducing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

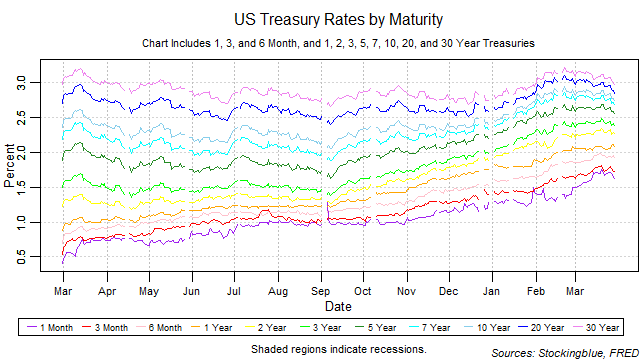

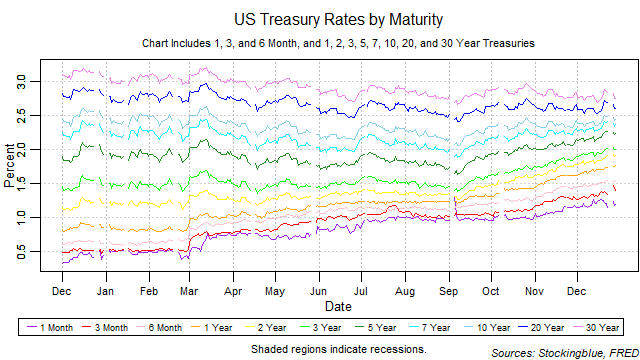

Treasury Rate Movements, March 2018

Short-term rates rose from the previous month, while long-term rates fell and medium-term rates were mixed. The yield curve narrowed from the previous month and broke its two month widening streak. Although the one-month bill rose the most, it maintained the lowest rate throughout the month. However, the yield curve has been narrowing from the short-term end for quite a while now and an inversion brought upon by rising short-term rates is a strong indicator for an upcoming recession. No inversion has occurred yet since this rise in short-term rates kicked off in late 2016.

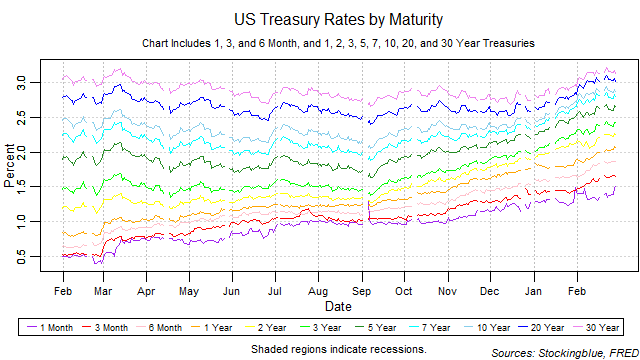

Treasury Rate Movements, February 2018

Short, medium, and long-term rates rose from the previous month. The yield curve widened a bit from the previous month and is on a two month widening streak. The one-month bill had maintained the lowest rate throughout the month.

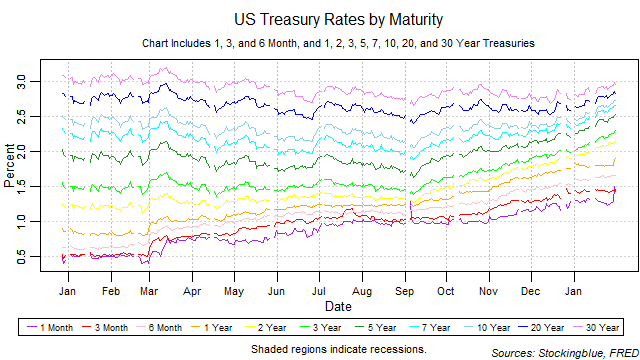

Treasury Rate Movements, January 2018

Short, medium, and long-term rates rose from the previous month. The yield curve widened a bit from the previous month reversing direction as it had narrowed in December. The one-month bill had one session where it held a higher rate than the three-month bill.

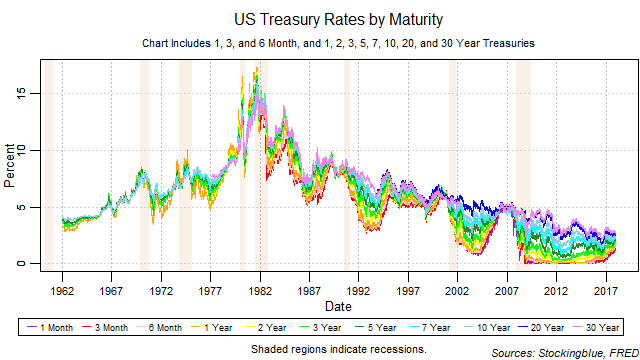

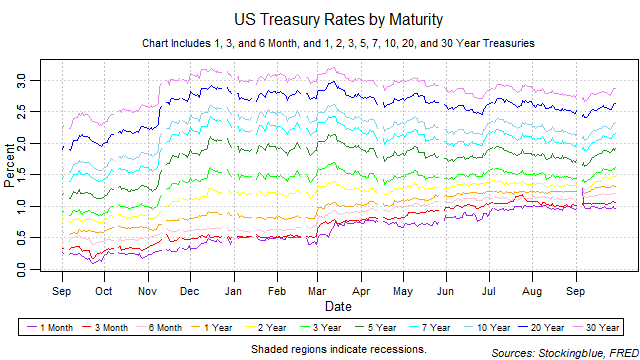

A Look Back at Treasuries in 2017

Short-term rates took a dramatic turn upwards after being stuck at zero for several years while long-term rates continued their slow and steady decline. The yield curve continued to narrow but it also narrowed from the bottom up. A narrowing from the short-term is a warning sign for an inversion that indicates recession.

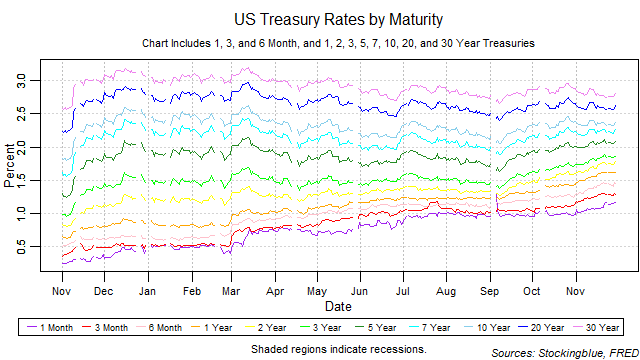

Treasury Rate Movements, December 2017

Short-term rates and medium-term rates continued to rise in December while long-term rates dropped from the previous month. The yield curve continued to narrow as it had in the previous month. Short-term rates have increased their rise in rates but the one-month bill had no sessions with higher rates than the three-month bill. That is, the one-month bill maintained the lowest rate throughout the month. However, the yield curve narrowed from both the short and long-term. A narrowing from the short-term is a warning sign for an inversion that indicates recession.

Treasury Rate Movements, November 2017

Short-term rates continued their rise in November while medium-term rates rose slower and long-term rates dropped from the previous month. The yield curve continued to narrow as it had in the previous month. Short-term rates have increased their rise in rates but the one-month bill had no sessions with higher rates than the three-month bill. That is, the one-month bill maintained the lowest rate throughout the month. However, the yield curve narrowed from the bottom up and that has been a steadfast indicator of recession.

Treasury Rate Movements, October 2017

Short-term rates continued their steady rise in October and medium and long-term rates tempered their rise from the previous month. The yield curve narrowed after widening in the previous month. Short-term rates have slowed their rise in rates but October breaks with the previous two months where the one-month bill had a session with higher rates than the three-month bill. That is, the one-month bill maintained the lowest rate throughout the month for the first time in three months. That is a promising sign as a narrowing of the yield curve from the bottom up has been a steadfast indicator of recession. All rates rose in October.

Treasury Rate Movements, September 2017

Short-term rates resumed their steady rise in September and medium and long-term rates returned to their relatively more rapid rise. The yield curve widened after narrowing further in the previous month. Short-term rates have slowed their rise in rates but September marks the second month in a row where the one-month bill had a session with higher rates than the three-month bill and an inversion of the yield curve from the bottom up has been a steadfast indicator of recession. No inversion has occurred yet but special attention needs to be paid to short-term rates in the near future. All rates rose in September.

Treasury Rate Movements, August 2017

Short-term rates paused their steady rise in August but medium and long-term rates began to fall. The yield curve continues to shrink but it only indicates a recession if it shrinks from the bottom up. The upward tick in the short-term maturities' rates pause is promising as it is a decent indicator that a recession is not on the horizon. All rates fell in August with the exception of the one-year note which rose slightly.

OlderNewer