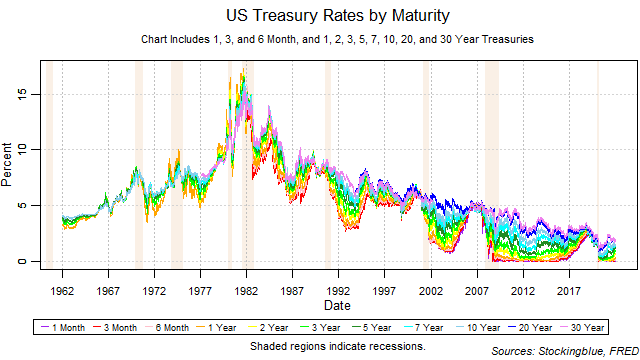

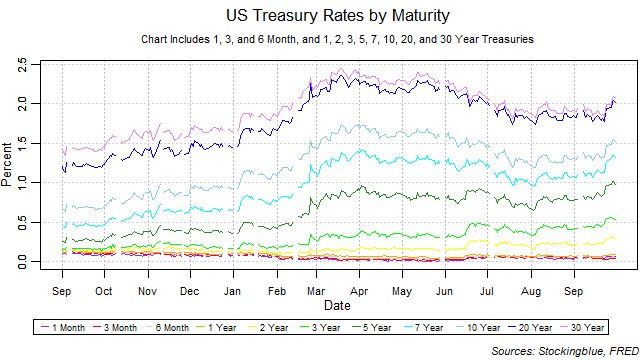

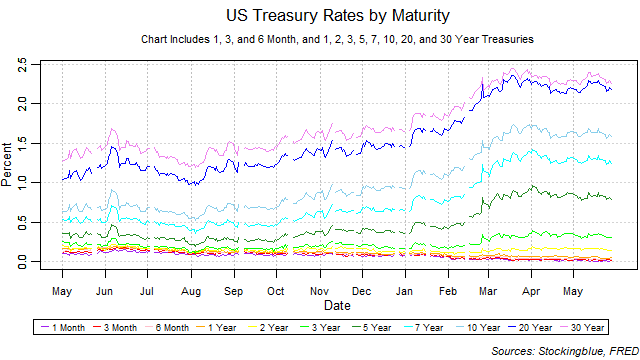

A Look Back at Treasuries in 2021

The one-month and three-month rates trended downwards for the third year in a row while all other rates went up ending their downward trend at two years. The yield curve widened over the course of the year. A narrowing from the short-term is a warning sign for an inversion that indicates recession.

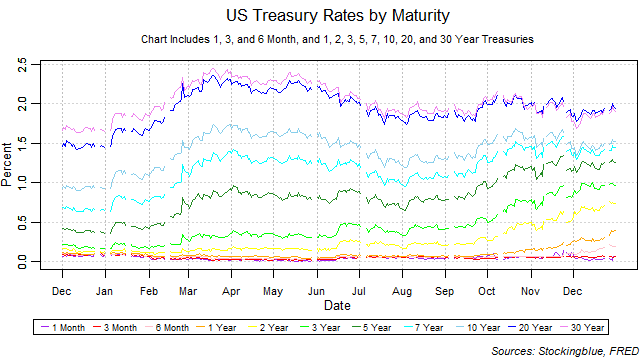

Treasury Rate Movements, December 2021

The one-month rate fell while all other rates rose in December. The yield curve widened from the previous month thus ending its narrowing streak at two months. The one-month bill did not maintain the lowest rate throughout the month and it shared the lowest rate. There were no major moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

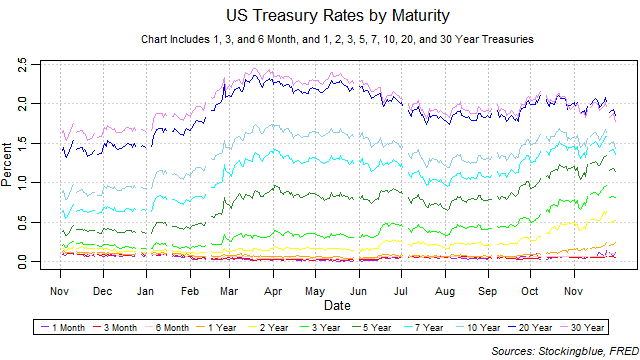

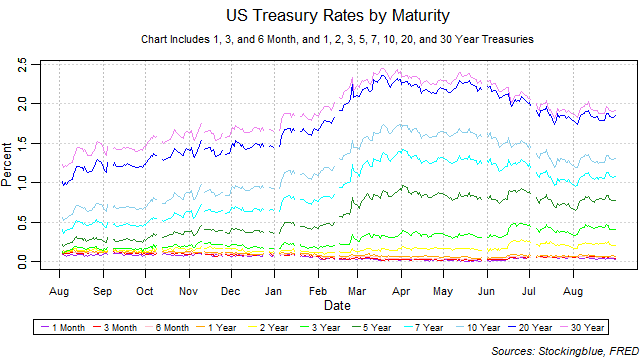

Treasury Rate Movements, November 2021

The five-year, seven-year, 10-year, 20-year, and 30-year rates fell, the three-month rate stayed the same, while all other rates rose in November. The yield curve narrowed from the previous month thus extending its narrowing streak to two months. The one-month bill did not maintain the lowest rate throughout the month and it shared the lowest rate on multiple occasions. There were moves upwards on short-term rates thus increasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

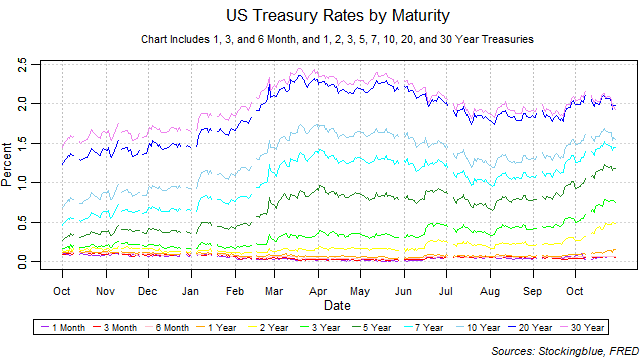

Treasury Rate Movements, October 2021

The one-month, 20-year, and 30-year rates fell while all other rates rose in October. The yield curve narrowed from the previous month thus ending its widening streak at two months. The one-month bill did not maintain the lowest rate throughout the month and it shared the lowest rate on multiple occasions. There were moves upwards on short-term rates thus increasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

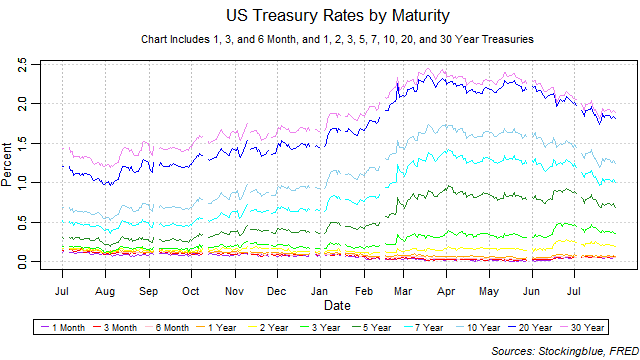

Treasury Rate Movements, September 2021

The six-month rate fell, the three-month rate stayed the same, while all other rates rose in September. The yield curve widened from the previous month thus extending its widening streak to two months. The one-month bill did not maintain the lowest rate throughout the month and it shared the lowest rate on multiple occasions. There were moves upwards on short-term rates thus increasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Treasury Rate Movements, August 2021

The one-month and three-month rates fell, the one-year rate stayed the same, while all other rates rose in August. The yield curve widened from the previous month thus ending its narrowing streak of four months. The one-month bill maintained the lowest rate throughout the month but it shared the lowest rate on multiple occasions. There were no moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

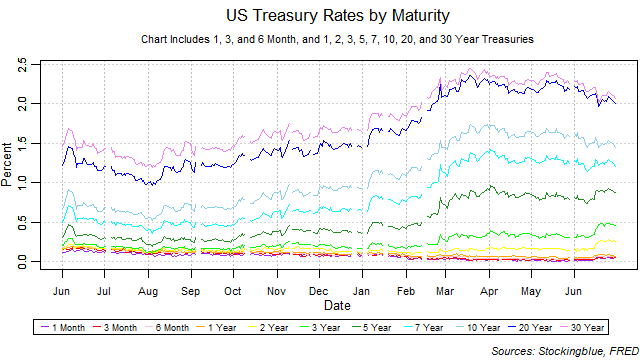

Treasury Rate Movements, July 2021

The three-month rate rose, the one-month and one-year rates stayed the same, while all other rates fell in July. The yield curve narrowed from the previous month thus extending its narrowing streak to four months. The one-month bill did not maintain the lowest rate throughout the month and it shared the lowest rate on multiple occasions. There were moves upwards on short-term rates thus increasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Treasury Rate Movements, June 2021

The seven-year, ten-year, 20-year, and 30-year rates fell, while all other rates rose in June. The yield curve narrowed from the previous month thus extending its narrowing streak to three months. The one-month bill did not maintain the lowest rate throughout the month and it shared the lowest rate on multiple occasions. There were moves upwards on short-term rates thus increasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

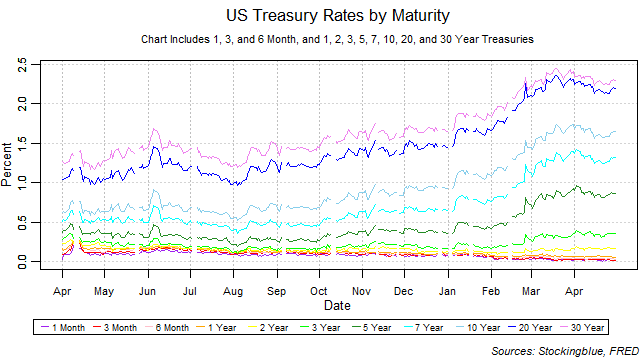

Treasury Rate Movements, May 2021

The one-month, three-month, six-month, and one-year rates remained the same, while all other rates fell in May. The yield curve narrowed from the previous month thus extending its narrowing streak to two months. The one-month bill maintained the lowest rate throughout the month but it shared the lowest rate on multiple occasions. There were no moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Treasury Rate Movements, April 2021

The one-month, two-year, and three-year rates remained the same, while all other rates fell in April. The yield curve narrowed from the previous month thus ending its widening streak of four months. The one-month bill did not maintain the lowest rate throughout the month and it shared the lowest rate on multiple occasions. There were no moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Older