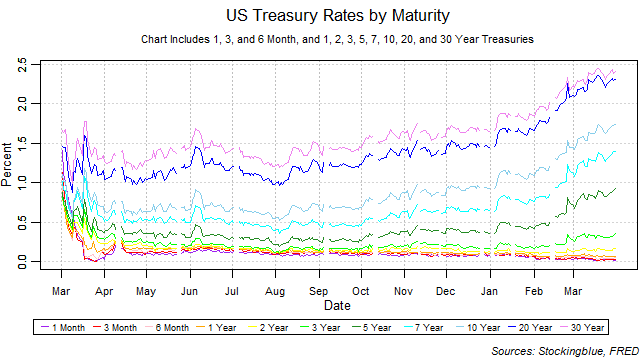

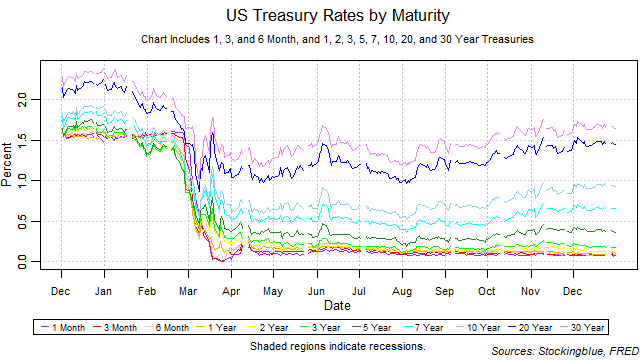

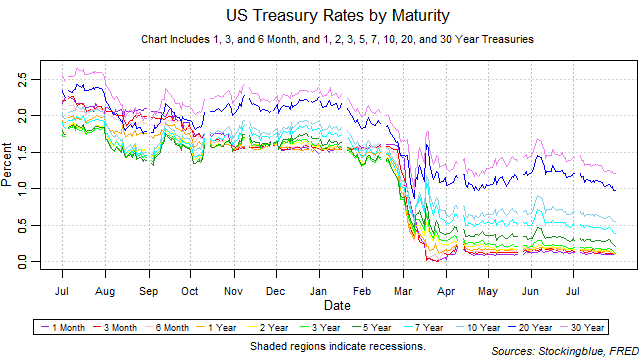

Treasury Rate Movements, March 2021

The one-month, three-month, and one-year rates fell, the six-month remained the same, while all other rates rose in March. The yield curve widened from the previous month thus extending its widening streak to four months. The one-month bill did not maintain the lowest rate throughout the month and it shared the lowest rate on multiple occasions. There were no moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

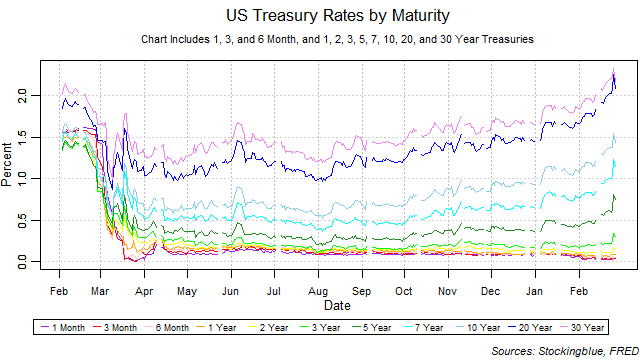

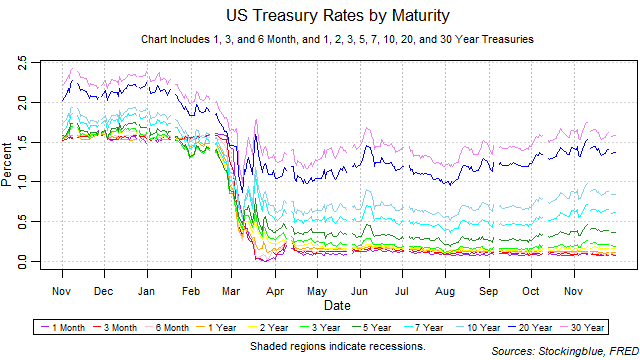

Treasury Rate Movements, February 2021

The one-month, three-month, six-month, and one-year rates fell, while all other rates rose in February. The yield curve widened from the previous month thus extending its widening streak to three months. The one-month bill maintained the lowest rate throughout the month although it shared the lowest rate on multiple occasions. There were no moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

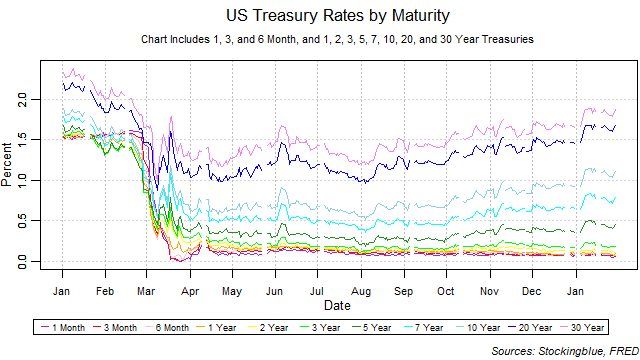

Treasury Rate Movements, January 2021

The one-month, three-month, six-month, and two-year rates fell, the one-year rate stayed the same, and all other rates rose in January. The yield curve widened from the previous month thus extending its widening streak to two months. The one-month bill did not maintain the lowest rate throughout the month. There were no moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

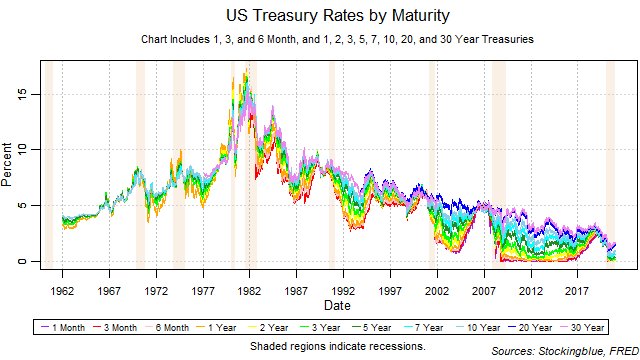

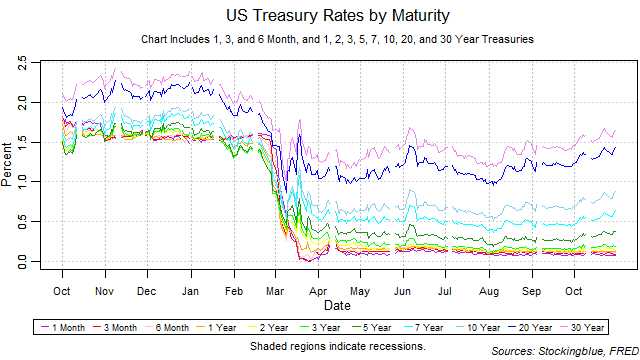

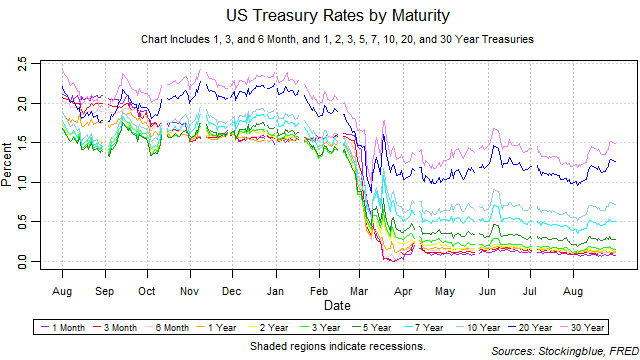

A Look Back at Treasuries in 2020

All rates trended downwards for the second year in a row. The yield curve widened over the course of the year. A narrowing from the short-term is a warning sign for an inversion that indicates recession.

Treasury Rate Movements, December 2020

The one-year, two-year, and three-year rates fell, the one-month, six-month, and five-year rates stayed the same, and all other rates rose in December. The yield curve widened from the previous month thus ending its narrowing streak of one month. The one-month bill did not maintain the lowest rate throughout the month. There were no moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Treasury Rate Movements, November 2020

The two-year rate rose, the one-month and three-year rates stayed the same, and all other rates fell in November. The yield curve narrowed from the previous month thus ending its widening streak of one month. The one-month bill did not maintain the lowest rate throughout the month. There were no moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

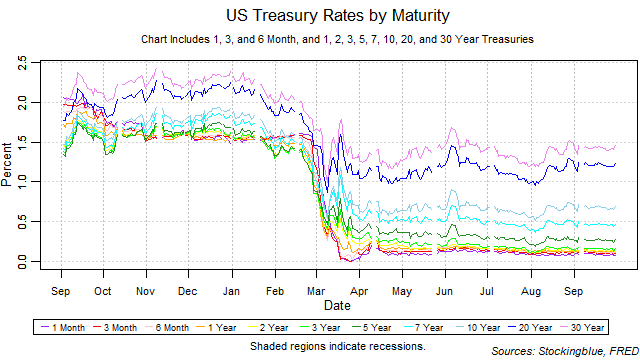

Treasury Rate Movements, October 2020

The three-month rate fell, the one-month and six-month rates stayed the same, and all other rates rose in October. The yield curve widened from the previous month thus ending its narrowing streak of one month. The one-month bill did not maintain the lowest rate throughout the month and shared it with the three-month on several occasions. There were no moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Treasury Rate Movements, September 2020

The three-year rate rose, the one-month, one-year, and five-year rates stayed the same, and all other rates dropped in September. The yield curve narrowed from the previous month thus ending its widening streak of one month. The one-month bill maintained the lowest rate throughout the month but shared it with the three-month on one occasion. There were no moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Treasury Rate Movements, August 2020

All rates except for the one-month bill rose in August. The yield curve widened from the previous month thus ending its narrowing streak of one month. The one-month bill did not maintain the lowest rate throughout the month. There were no drastic moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Treasury Rate Movements, July 2020

All rates fell in July. The yield curve narrowed from the previous month thus ending its steady streak of one month. The one-month bill did not maintain the lowest rate throughout the month. There were no drastic moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

OlderNewer