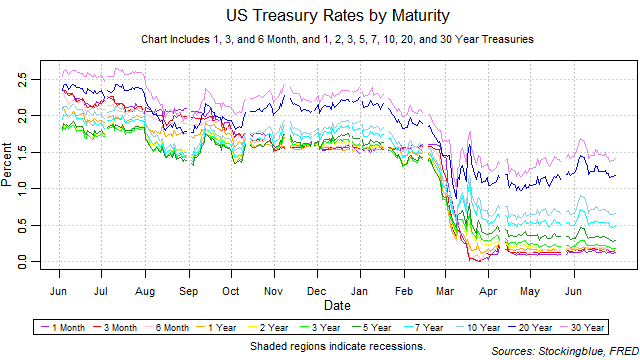

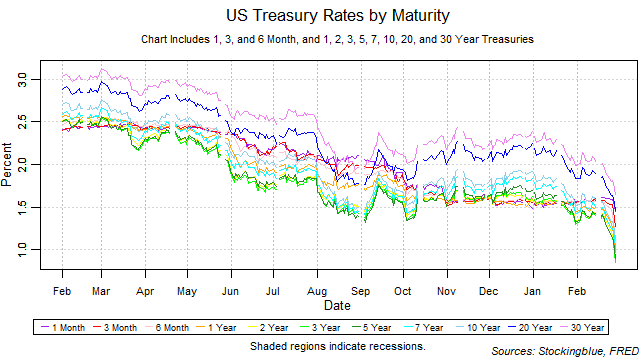

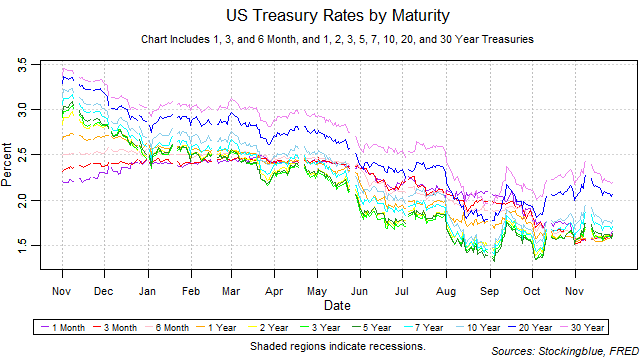

Treasury Rate Movements, June 2020

The one, three, five, and seven-year rates fell while the one and six-month and the two, 20, and 30-year rates remained the same, and the three-month and ten-year rates rose in June. The yield curve remained unchanged from the previous month thus ending its widening streak of one month. The one-month bill maintained the lowest rate throughout the month. There were no drastic moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

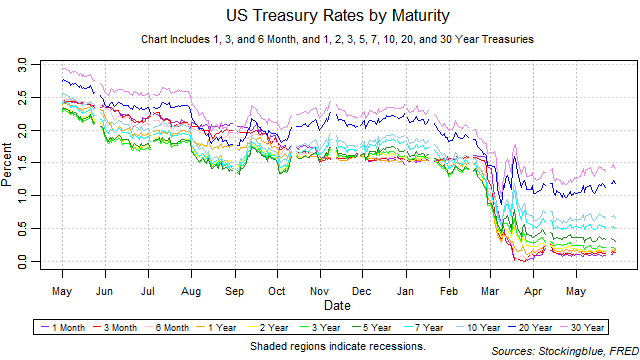

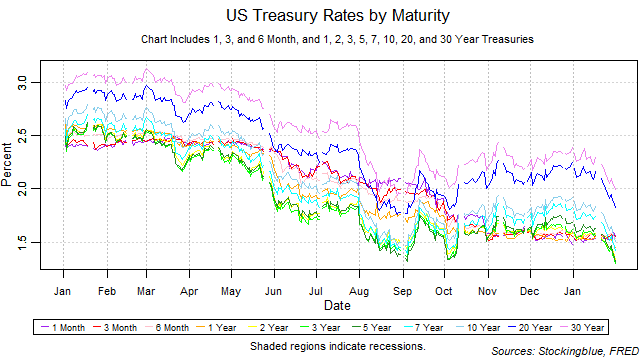

Treasury Rate Movements, May 2020

All rates except for the two, three, five, and seven-year notes rose in May. The yield curve widened from the previous month thus ending its narrowing streak of one month. The one-month bill maintained the lowest rate throughout the month. Long-term and short-term rates rose while medium-term rates rose thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

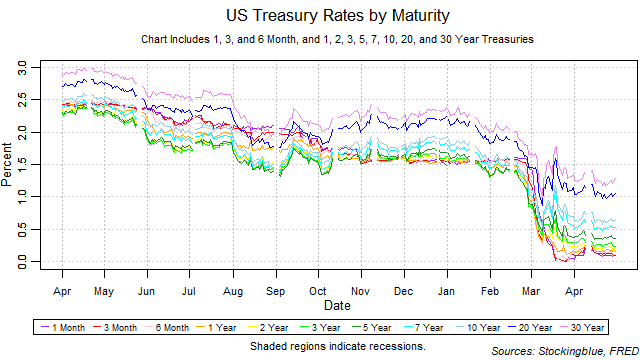

Treasury Rate Movements, April 2020

All rates except for the one-month bill fell in April. The yield curve narrowed from the previous month thus ending its widening streak. The one-month bill did not maintain the lowest rate throughout the month. Long-term rates fell while short-term rates rose thus increasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

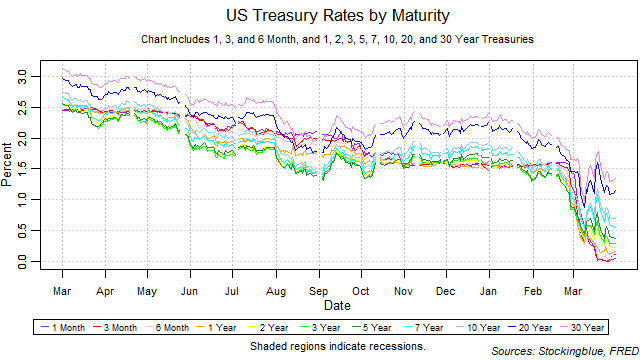

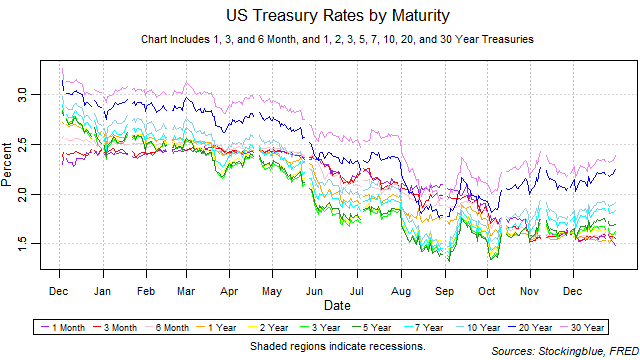

Treasury Rate Movements, March 2020

All rates fell in March. The yield curve widened from the previous month thus extending its widening streak to two months. The one-month bill did not maintain the lowest rate throughout the month. All rates fell thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Treasury Rate Movements, February 2020

All rates fell in February. The yield curve widened from the previous month thus ending its narrowing streak of one month. The one-month bill did not maintain the lowest rate at any point during the month. All rates fell thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Treasury Rate Movements, January 2020

The one-month rate fell in January, the three-month remained unchanged, while all other rates rose. The yield curve narrowed from the previous month thus ending its widening streak of one month. The one-month bill did not maintain the lowest rate throughout the month. Long-term rates fell while short-term rates rose thus increasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

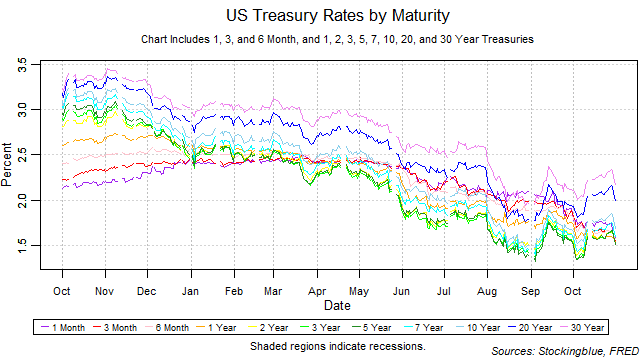

Treasury Rate Movements, December 2019

The one, three, and six-month, and the one and two year rates fell in December while all other rates rose. The yield curve widened from the previous month thus ending its narrowing streak of one month. The one-month bill did not maintain the lowest rate throughout the month. Long-term rates rose while short-term rates dropped thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

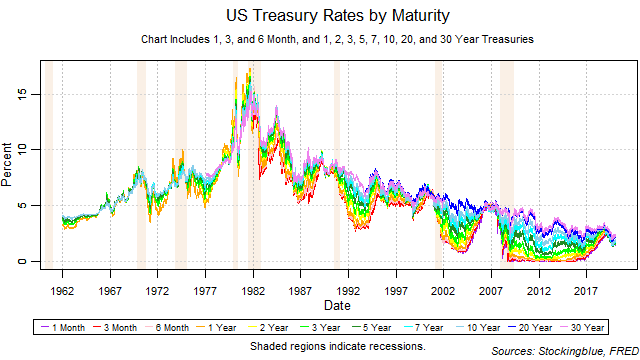

A Look Back at Treasuries in 2019

All rates trended downwards following their dramatic turn upwards the previous year after being stuck at zero for several years. The yield curve widened over the course of the year. A narrowing from the short-term is a warning sign for an inversion that indicates recession.

Treasury Rate Movements, November 2019

All rates rose rose in November. The yield curve narrowed from the previous month thus ending its widening streak at one month. The one-month bill held the lowest rate three times and shared the lowest rate one time in the month. All rates rose at an even pace thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion is a strong indicator for an upcoming recession.

Treasury Rate Movements, October 2019

All bill and note rates fell except for the ten-year note which along with all bond rates rose in October. The yield curve widened from the previous month thus ending its narrowing streak at three months. The one-month bill did not maintain the lowest rate at any point in the month. Long-term rates rose while short-term rates dropped thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion is a strong indicator for an upcoming recession.

OlderNewer